Industrial & Commercial Real Estate Appraisal

Valuation for Industrial, Manufacturing & Complex Assets

At Alpha Consulting US, commercial real estate appraisal is practiced as a valuation discipline, not a volume-driven service. Our appraisal work is focused on industrial, manufacturing, and complex commercial assets where asset function, infrastructure, and capital exposure materially affect value.

Appraisal is provided selectively and typically in support of:

- Enterprise valuation

- Cost segregation

- Tax, litigation, or transaction advisory

- Capital and risk analysis

We do not pursue commodity appraisal assignments.

Core Asset Focus

Industrial & Manufacturing Emphasis

Our appraisal practice is anchored in process-driven and infrastructure-intensive properties, including:

- Manufacturing plants and production facilities

- Advanced materials and specialty processing plants

- Industrial campuses and multi-building facilities

- R&D and technology-oriented industrial assets

- Heavy utility, power, and process-driven improvements

- Logistics and distribution facilities supporting industrial operations

These assets require valuation grounded in engineering logic, capital structure, and functional obsolescence, not just market comparables.

Additional Commercial Property Types (Selective)

We also provide appraisal services for complex commercial property types including:

- Office and corporate headquarters

- Mixed-use developments

- Hotels, resorts, and hospitality assets

Special-Purpose & Infrastructure-Oriented Assets

We appraise special-purpose and non-standard assets where traditional appraisal frameworks often fail:

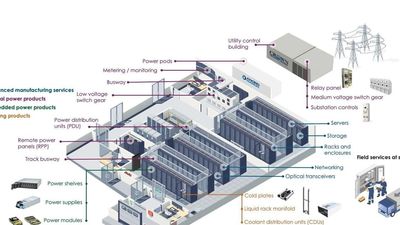

- Power-related and utility-adjacent real estate

- Transportation-oriented assets (parking structures, terminals)

We conduct portfolio valuations for:

- Industrial and logistics portfolios

- Mixed-use commercial holdings

- Institutional real estate platforms

Portfolios may be appraised on:

- An individual asset basis

- A consolidated portfolio basis

- A capital-structure-informed valuation framework

What Differentiates Our Appraisal Practice

Our appraisal work is distinguished by:

- Industrial and manufacturing specialization

- Integration with enterprise valuation and cost segregation

- Engineering-informed asset analysis

- Conservative, audit-ready documentation

- Defensible opinions suitable for judicial, regulatory, and tax scrutiny

Positioning Statement

Commercial real estate appraisal at Alpha Consulting US is not a standalone commodity service — it is a strategic valuation function deployed where asset complexity, infrastructure, and capital exposure demand higher-order valuation judgment.

Copyright © 2020 AlphaConsultingUS.com - Valuation Economist - Data Centers, Power & Nuclear. All Rights Reserved. CVA (Certified Business Valuation Analyst), ASA (Accredited Senior Appraiser), CCIM (Certified Commercial Investment Member), CM&AA (Certified M&A Advisor), MAFF (Master Analyst in Financial Forensics).

(Certified General Real Estate Appraiser in States of CA, NV, TX, OR, WA, AZ, HI, GA, VA, DC, MD), (Licensed Real Estate Broker in States of CA , TX, WA, GA)

한미 FDI 실사 자문 가치평가 , JAPAN-US FDI Advisory, Taiwan-US FDI Advisory

Affiliated platform: Hahn USA , visit https://hahnusa.com/ — Capital-Critical Real Estate Advisory

Select tax-driven valuation services are performed through US Valuation, a specialized affiliated advisory platform. Please visit our affiliate website at: https://usvaluation.com/